The High Cost of Eating Out and a Goal Update

A happy Monday to all of you! Looks like a busy, fun, productive week is ahead for me. I hope you have good things ahead for you too! Make sure to read all the way to the end for some bonus material in the ‘final thought’ section.

I was taking a look back at January over the weekend and wanted to share some thoughts on our biggest savings, well, really my biggest savings in the first month of 2013. Simply stated, I got real sloppy in 2012. The more I look back the more I realize that I was out of control in many areas of my life. It happens. The key, I guess, is getting things pulled back together. I’ve already written about the breakdown in my savings habits, and those are back on track now. But I came to realize a real problem for our pocketbook and my health was in my eating habits.

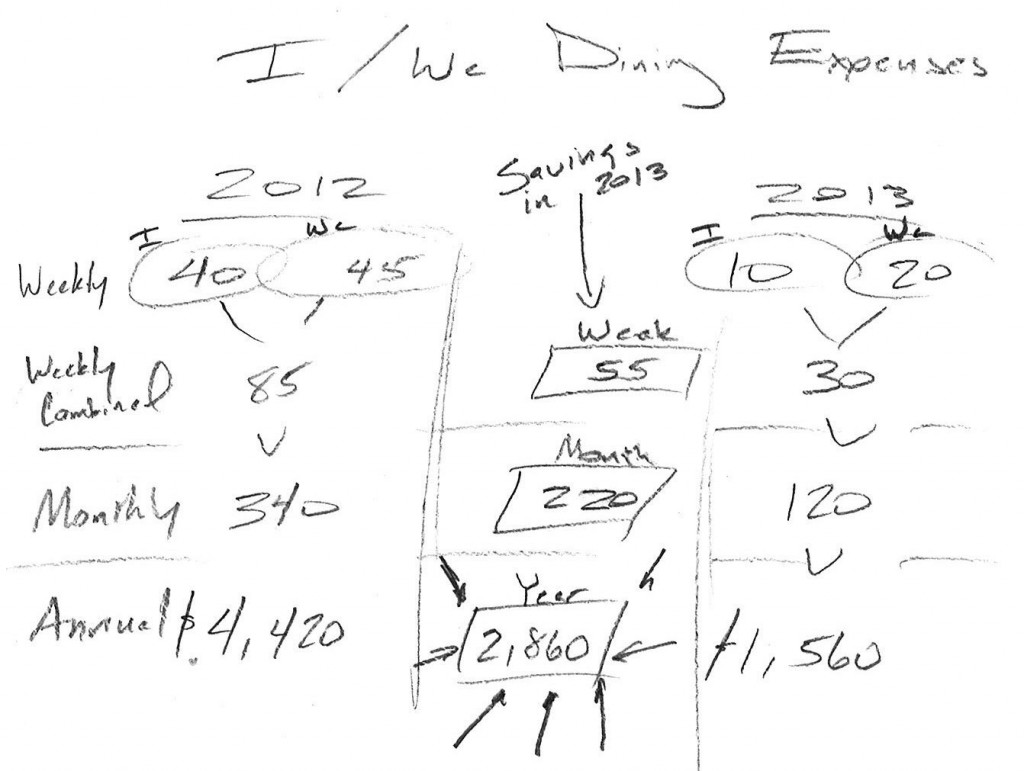

In a typical work week, I was eating out everyday. Whataburger, Taco Bueno, Wendy’s, Potbelly’s and Panda Express might make up a typical week of lunches for me. I cringe now when I think about the calories, fat, cholesterol and other things I was pumping myself full of over the last year. Hopefully my body is young enough to bounce back with our new healthy diet and added daily activity. Aside from the health impact, that food is expensive! A quick average of my typical meals at those places adds up to $40 per week. Over the course of a year that is approximately $2,000. As a family, we were also eating out or bringing in food twice a week at an average cost of $45 per week. So, in eating out “I” and “we” were spending approximately $4,300 a year. A dollar here and five dollars there really does add up.

What do we look like so far in 2013? As an individual, I have brought my lunch to work almost everyday. Almost always it is leftovers from things we have fixed as a family, a sandwich or a stash of Smart Ones I keep in the freezer that cost $1.50 each. If I do eat out, it is almost always when I sit down with a peer to discuss ministry matters. My meals also don’t cost as much since I don’t get a soda anymore, which means I don’t get a combo meal anymore. I can usually get a meal for $4 or less. As a family, I think we have eaten out / taken in about 3 times so far in 2013 at a cost of approximately $20 a meal. For the purposes of evaluation, let’s just say I spend $10 a week on lunch in 2013 and as a family we spend $20. That is an average of $120 a month, which is a savings of $220 per month on average when compared to 2012. By the end of the year that adds up to $2,860 in savings or a reduction in eating out costs of at least 65%. And of course those are just averages, in reality we actually do a bit better than that.

I’ve included a scan of my ROUGH notes on dining expenses. Sketching things out like this helps me visualize the change that needs to happen. My handwriting is atrocious because I did this sketch EARLY one morning while working on the treadmill desk. Between the rough grain of my wooden work surface on the treadmill and the movement of walking, my handwriting looks like that of a first grader, but I think you can still make it out…

For the record, my wife has always been frugal in this area. She works two days a week and on those days she either brings her lunch or spends $2 in the hospital cafeteria on beans and cornbread, one of her favorite meals. And when she is out with our girls she almost always makes sure to pack a lunch for everybody, even though it might be more difficult than zipping through a drive-thru. I’m blessed with a frugal wife! It’s also worth noting, that the dinners we have been preparing at home cost between $6 and $10 each and feed our family for at least three meals on average.

For the record, my wife has always been frugal in this area. She works two days a week and on those days she either brings her lunch or spends $2 in the hospital cafeteria on beans and cornbread, one of her favorite meals. And when she is out with our girls she almost always makes sure to pack a lunch for everybody, even though it might be more difficult than zipping through a drive-thru. I’m blessed with a frugal wife! It’s also worth noting, that the dinners we have been preparing at home cost between $6 and $10 each and feed our family for at least three meals on average.

Over at EdwardAntrobus.com I took part in an interesting series of comments on his post about the common saying, “A penny saved is a penny earned.” I’ve often said this to our five year-old, but one day she asked me, “What does that mean Daddy?” I couldn’t explain it to her. In the comments on Edward’s post, we concluded a more accurate saying might be, “A penny saved is a penny you don’t have to earn.” Not quite as catchy, but more accurate. Money saved throughout the years is less money that has to be earned over a lifetime. Still not a concept that our five year-old is fully prepared for 🙂

How will we know what we are spending?

We have to keep track of expenses. In February, my wife and I started writing down every dollar that we spend. We have done this before and it really helps to paint a detailed picture of where our money is going. As Christians, we believe that the money we are given is a blessing (a resource) given by God that we should be using as wisely as we can. So we’re doing everything we can to be accountable with our money. Writing down all expenses also helps me visualize areas where I can do better as an individual and where we can work together as a family to cut back. In the era of autopay, debit cards and click-to-buy it is amazingly easy to lose track of finances.

What kind of success have you been having with financial goals in 2013? What changes have you made? How do you keep track of where your money goes?

A goal update…

As I mentioned on Saturday, I feel my goal with soda is getting to the point where it is on cruise control. I have the occasional 8 oz. bottle of “real sugar” Dr. Pepper at home with a meal, and I can count on one hand the number of times I have had a soda at a restaurant in 2013. That is a HUGE change and success from 2012 and previous years. My Dad, who has always been one of my biggest sources of encouragement, noted how I am thinning out especially in my face. My wife has also made it a point to encourage me with frequent compliments. It is a blessing to be surrounded with encouraging, loving family and friends.

I can feel a change too. Our five year-old always wants to race when we are outside. Typically I have always been too tired to race, and when I do, I feel OLD. This week we took off running for the mailbox and it actually felt good. She is a speedy little kid and she was shocked when her Daddy went zipping past her for the win 🙂 She won the race back to the house though. I am also able to go all day at the office, help out with chores at the house and get fun things done like taking care of the chicks, starting seedlings for the garden, etc.

It should also be noted, I continue to love working on the treadmill desk. I have been walking and working on this thing for 8 weeks now and have logged over 150 miles! With an average of at least 20 miles a week, it is possible that I might walk and work over 1,000 miles in the year. We shall see.

A final thought…

I didn’t catch even one minute of the Super Bowl last night. I hear it was a good game. Between worship last night and spending time with the family, the TV just never got turned on. Thanks to social media I was able to catch the highlights of the commercials. By far, the one that impressed me the most was the Dodge Ram spot that featured Paul Harvey. Amidst the trashy, raunchy, and bombastic commercials was this simple, pure and emotionally charged two minute commercial from Dodge. Hearing Paul Harvey’s voice brought back memories of riding in the car with my parents growing up. What a great American orator and story teller. If you haven’t seen the commercial, it’s worth checking out.

[weaver_youtube http://www.youtube.com/watch?v=AMpZ0TGjbWE sd=0 percent=100 ratio=.5625 center=1 rel=0 https=0 privacy=0 see_help_for_others]

Make it a great week! And you can still check out our little chicks on cam 🙂 We have two survivors and they seem to be doing very well and are lots of fun to watch. Also, if you’re new here please consider subscribing via Email or RSS (top right of the page) to keep up with future updates. Thanks!

Good luck on your dining out challenge. I’ve been trying to switch to water as well, but I drink water almost exclusively at home and it’s tempting to switch it up when out.

Thanks Edward! When eating out is also my most tempting time to drink soda, and sometimes I do. I have really been enjoying your blogs posts since finding your site.

I found this to be very intrestig. Iv’e given serious thought to some 0f the advice. especially the how to spend money. Please continue the help

I found this to be very intresting. I’ve given some serious thought to some of the advice, like the know how to spend money. continue the help.

Thanks Coy! Spending time with you and Joe and getting back in touch with real food at the market really inspired some changes in the way I have been eating and living. You guys are such a blessing to me!

First, a hypothetical: Let’s say you pick cotton for $1 a day. You can bring food for lunch, perhaps a couple of bisquits and some cooked bacon, or for 3 cents the boss will give you a couple of slices of bread and a piece of cheese. You’re paid daily so at the end of the day, if you took the boss up on his offer, you get 97 cents. But you DID bring those bisquits and bacon, so at the end of the day you get paid $1. A penny (or 3) is a penny earned. …just a thought.

Back in the early 70’s I adopted a phrase first uttered by Phil the pharmacist. I don’t recall it’s specifics, but I have tried to instill it in the minds of both my kids as well as a few other folks. It is: FIFTEEN DOLLARS IS FIFTEEN DOLLARS. It’s meaning has a bit of flexibility, but basically is: Think about whether this is really what you want to spend your money on OR Now don’t just go out and blow that money OR You need to be saving not spending OR Every little bit helps OR It’s money I didn’t have before ….you get the idea. Basically it’s a warning sign of sorts that says PAY ATTENTION to what you do or are going to do w/ this money (most likely NOT exactly $15). Ask Catie about it sometime.

We were just talking about our budget last night and were discussing where the “leaks” are…we know that eating out is a huge one for us…but we travel a lot and that seems to make it more difficult to cut out that spending. We’re going to keep track of every dollar we spend on food and break it down to at home and eating out. Hopefully we can find (and plug!) the leaks that we find!

It’s amazing how that money seems to disappear as quickly as it comes in. Great job on tracking the money you spend. That exercise has always been eye opening for our family. Good luck and thanks for reading and commenting!

Pingback: Places I've Been: December 23, 2012-February 6, 2013 | Edward Antrobus