Money Boo Boos and a Goal Update

My wife and I are thinking about setting a crazy financial goal for our family for the remainder of 2013. I’m not quite ready to write about it yet, but I thought I would share a few money boo boo’s that I have made over the years…and more importantly the lessons that I learned from my mistakes.

Not having a budget

I would be curious to find out how many of you good readers have a budget. I’m talking an actual dollar and cents budget. Not just a rough idea of what comes in and what goes out, but somewhere written down or on a computer you have a plan for your money. Most surveys that I have seen say that less than 50% of Americans have any kind of budget.

My wife and I have never really had a budget. It has always been a downfall of mine as the head money manager of the house. Thankfully we live a fairly modest lifestyle for our income level so it has not been a problem, but we could be doing better. We simply survive where I want to thrive. We don’t live pay check to pay check but we don’t have the savings to survive a 6 month job search without selling something.

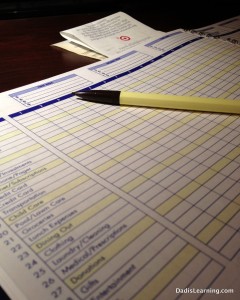

The closest thing to budgeting we have ever done is writing down every dollar we spend. I am not sure how well this compares to budgeting. If it costs a $1 or more it goes in the book. I try to divide everything out into the various categories as best I can. I hold onto the Target receipts because those are the worst to classify – food, clothes, etc. all on one ticket.

For us this seems to be the best real-life solution. We have a rough idea of where money will be going, how it is allocated into various savings funds and then where the rest of our money is spent. If you’ve been reading my financial posts for a while, you know that I stopped doing this in 2012 because that is the year I got fiscally (and physically) lazy. 2013 is all about kicking some fiscal (and physical) booty!

Our recording system wouldn’t be something that Dave Ramsey would probably recommend, but it works for us. I figure the important thing is being able to analyze spending patterns. If someone were to ask me what we spent on dining out in February 2013, I could tell them. When we analyze our spending for issues, we should be able to spot them pretty easily.

Wasted Food

We have really been working as a family to eat better in 2013. We try to eat as much real food as we can, preparing meals at home as much as possible. As I have talked about many times, I have cut WAY back on my beloved Dr. Pepper. We still have a problem with food though, we waste A LOT.

Later today I will go through our fridge since tomorrow is garbage day. I will pull out the things that are no longer good, that we just didn’t get to. I will gladly throw away the half a parfait that was leftover from my failed healthy chocolate pudding experiment. But I know there will also be some good, wholesome food that went to waste in our fridge or in the pantry.

As we have worked to correct bad eating habits, I have noticed that we are wasting less food. We still waste food though. I think part of the reason is because we have little kids in the house and as much as we try to eat their leftovers, we still waste some. We do a better job of not letting food spoil, but real food spoils pretty quick which is something that has to be adjusted to as well.

Over at Greatist.com they had a great list of 29 ways to cut down on food waste. Number 7 on the list stood out to me – “Monitor what you throw away.” They suggested keeping a list for a week of food items that you throw out on a regular basis and making necessary adjustments.

Bi-Monthly Mortgage Payments

I apparently missed the sucker alert on this one. When we first built our house I received a notice from our mortgage company that for a small fee we could split our mortgage payment in half and pay it once every two weeks, thus completing our mortgage payments years in advance.

If you’re quick with math, you’ve already figured out that the savings don’t come from paying half of the mortgage early each month, but they actually come from making 13 full mortgage payments a year instead of 12. This is something I could easily do on my own without paying someone $3.95 a month to do for me.

I simply took my mortgage payment, divided it by 12 and added that extra amount onto each month’s mortgage payment. In theory that should actually save a bit on interest since the extra mortgage payment is made throughout the year instead of at the end of the year. The biggest thing is that I am no longer wasting $48 a year to do something I should have been able to figure out on my own.

What mistakes have you made that someone might learn from? Share what you dare in the comments section below!

Goal Update

My Monday post would be incomplete without an update on my goal of cutting back on soda and being more active. This last week was not my best week, and just as I thought things were going on cruise control. Perhaps there is a lesson there? Anyway, we ate out 2 times and I had soda with both those meals. One was pizza with the family…pizza needs soda. The other was a date with my lovely wife. Soda just felt right. And I ate at Whataburger one day last week when I forgot my lunch…but I behaved and ordered healthy food (for Whataburger) and drank water.

It’s nothing to worry about, just a realistic week. This week is a new week and I’m off to a good start although I didn’t pound out too many miles on the treadmill desk today. Have I mentioned lately that I love my treadmill desk???

Better “Money Boo Boo” than “Honey Boo Boo” …@ least from what I’ve heard.

From what I’ve heard too…never seen the show.

“Pizza needs soda” is mindset that can be changed! Also, since I made water my primary drink choice several years ago, I always order water when we eat out, though Jack orders soda! YOU can do it, too, if you set your mind to it!

Thanks Donna! There are a few things I’m still working out, but getting better everyday 🙂

I confess that I’ve never really used a budget that holds me to dollars and cents. I do try to keep my overall spending to limits, but I think I could benefit from something more organized.

I hear ya Alex! Life seems to be so unpredictable that it is hard to imagine living on a structured budget.

Jon, After 34 yrs of marriage we have changed the way we budget a few times. Basically Doug gives me so much monet every pay period and that goes for food,clothes,eating out and other necessities. Doug takes care of all the major bills. For electricity and I believe gas we are on the budget plan so we pay the same amount every month and then at the end of the year we either pay the extra or get a rebate towards the next year. Unless we have unusually cold or hot weather we work out pretty equal. We also put all of our change eevery day in a jar and save it for vacations or something special. It is surprising how fast that can build up. Linda

Sounds like you and Doug have worked out a great plan! I think the key is finding something that works for you. We save change too. I always love the trips to the bank to cash it in. Our older daughter is really good at guessing how much change is in the bag…its kind of scary.